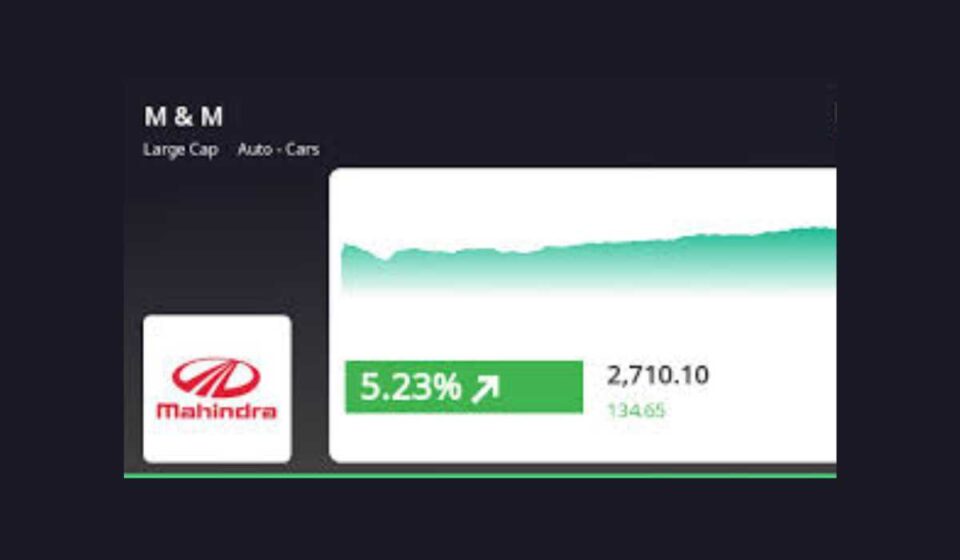

Mahindra & Mahindra has experienced a notable surge in its stock prices, with a 5.57% increase attributed to robust sales and improved profit margins in its electric vehicle (EV) division. The company’s consistent focus on its EV portfolio has been a driving force behind its success. By meeting rising demand for sustainable transport options, both domestically and internationally, Mahindra has positioned itself as a leader in the Indian EV market.

This uptick in stock value reflects Mahindra’s strategic pivot toward sustainability. The company has secured several key partnerships with global battery suppliers, ensuring the reliable production and delivery of its electric SUVs and trucks. These collaborations are critical as Mahindra continues to ramp up EV production to meet the growing demand for eco-friendly vehicles.

In contrast to some competitors, Mahindra has managed to navigate the challenges associated with transitioning to electric mobility. Other automotive companies have faced hurdles, including supply chain disruptions and slower adoption of EV technology. However, Mahindra’s forward-thinking strategies and strong supplier relationships have allowed it to maintain consistent production and growth.

The company’s EV offerings, particularly in the SUV segment, have resonated well with consumers who are increasingly opting for environmentally friendly transport solutions. Mahindra’s ability to offer reliable and affordable electric vehicles has further boosted its appeal in both the domestic and international markets. The company’s emphasis on sustainability aligns with global trends, contributing to its positive stock performance.

Looking ahead, analysts predict sustained growth for Mahindra as the company continues to expand its EV portfolio. With government incentives and increased consumer interest in green vehicles, Mahindra’s stock is expected to remain on an upward trajectory, making it a key player in the global transition toward electric mobility.